Application Onboarding in Banking: RFP Vendor vs. Internal Build Strategies

1. Introduction

The purpose of this case study is to understand the requirements of the Business Analyst role (Job Req ID: JR-0000033931) at Barclays and to demonstrate a strong interest in the position by showcasing relevant skills and capabilities. In today’s competitive job market, it is essential to go beyond traditional applications and present one’s candidature through innovative and thoughtful approaches. This document is a reflection of that effort — aimed at highlighting analytical thinking, domain understanding, and problem-solving abilities through a real-world business case. As the focus is aligned specifically with the expectations for the Business Analyst role at Barclays, special attention has been given to ensure relevance and strategic fit.

2. Abstract

This document explores efficient application onboarding strategies within the banking domain, aligning with the Business Analyst role at Barclays. It highlights key considerations in choosing between RFP/vendor-based solutions and internal builds, reflecting core competencies such as understanding transaction banking, product pricing, requirement gathering, and data-driven decision-making. The insights presented aim to support strategic digital transformation and operational excellence.

3. Evolving Customer Expectations & Digital Shift in Banking

3.1 Decline of Physical Branches: A Strategic Transition

Over the past few years, Barclays—like many traditional banks—has been strategically reducing its physical footprint across the UK. The decline in branch numbers from 2023 to 2025 reflects a shift from branch-based operations to a more agile, cost-efficient digital infrastructure. This transformation aligns with the industry-wide move toward digital-first banking experiences, where speed, convenience, and personalization drive customer loyalty.

As digital services become central to customer interaction, backend systems like application onboarding platforms must evolve to support seamless, scalable digital journeys.

3.2 Voice of the Customer: Survey Insights from IPSOS and BVA BDRC

Recent survey insights reveal key trends:

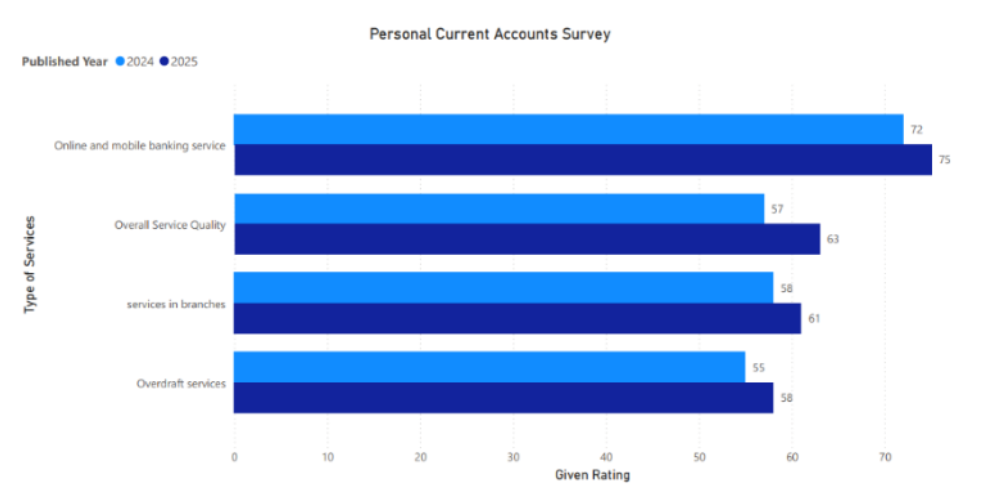

- Personal Account Holders (IPSOS Survey): Ratings for online and mobile services show consistent improvement (ranking 9 in UK), highlighting an increased reliance on digital channels.

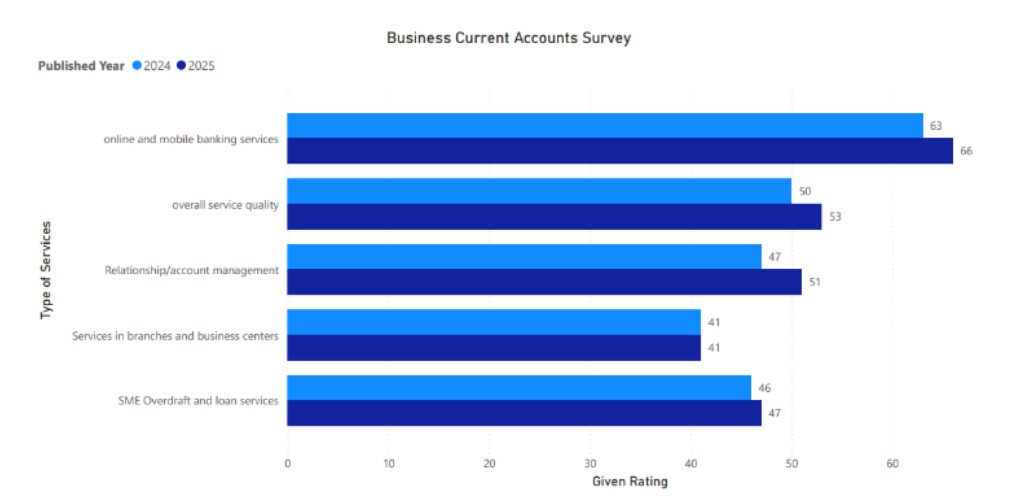

- Business Account Holders (BVA BDRC Survey): Business customers also rank digital services higher than in-branch alternatives, especially small and medium enterprises that need speed and ease of access.

These findings emphasize the need for modernized onboarding processes that integrate compliance, verification, and customer experience into one digital workflow.

3.3 Why This Matters Now

Branch closures and rising digital expectations necessitate scalable digital transformation. Banks must decide between external vendor solutions and internal builds not solely based on cost but on alignment with the digital-first vision and customer satisfaction goals.

4. Application Onboarding in Banking: RFP Vendor vs. Internal Build Strategies

Banks must integrate new applications efficiently, balancing speed, cost, compliance, and risk. Two approaches dominate: RFP/vendor-based adoption and internal builds.

RFP-Based Vendor Onboarding

- Speed/Time-to-Market: Vendor platforms, often cloud-based, enable rapid deployment—reducing development timelines by months or years.

- Cost: Lower upfront costs but involve recurring licensing and maintenance fees.

- Scalability: SaaS platforms easily accommodate user growth.

- Regulatory Compliance: Prebuilt compliance modules simplify KYC/AML processes but still require bank oversight.

- Vendor Lock-In Risk: Reliance on a single vendor limits flexibility and may raise switching costs.

- Integration Complexity: Integrating vendor platforms with legacy systems can be challenging.

Example: Police Bank adopted the Gatekeeper vendor platform through an RFP to automate supplier onboarding, achieving faster approvals and centralized compliance tracking.

Internal Build Strategy

- Customization & Control: Offers full functional and design control; suits complex workflows.

- Time-to-Market: Slower due to lengthy development and testing cycles.

- Cost: High upfront costs, though long-term ROI may improve for core systems.

- Scalability: Depends on architectural foresight.

- Compliance: Full control but also full responsibility for updates.

- No Vendor Dependency: Provides autonomy but risks internal knowledge silos.

- Risk of Failure: Higher in complex projects without rigorous governance.

Comparative Trade-Offs

| Dimension | Vendor Approach | Internal Build | Hybrid Approach |

|---|---|---|---|

| Speed to Market | Fast | Slow | Balanced |

| Cost | Lower upfront | High initial | Balanced |

| Customization | Limited | High | Selective |

| Compliance | Prebuilt modules | Fully owned | Combined |

| Vendor Lock-in | Risk present | Avoided | Controlled |

5. Case Studies and Strategic Insights

- Police Bank (Australia): Adopted Gatekeeper vendor platform, reducing onboarding time drastically.

- Barclays: Implemented nCino Cloud Platform to streamline KYC and loan origination—illustrating vendor-led agility without losing governance.

- Fifth Third Bank: Opted for a “buy more than build” approach due to limited IT budgets compared to large banks like JPMorgan.

Barclays’ global tech centers (e.g., Pune, Chennai, Mumbai) enable hybrid models—combining vendor cores with custom-built modules for analytics and UX.

6. Key Insights

- Time-to-Market: Vendors excel; in-house builds risk delays.

- Cost: Vendors are cheaper initially; in-house may pay off long-term.

- Scalability: Cloud vendors handle this efficiently; in-house requires intentional architecture.

- Compliance: Vendor options ease regulatory setup but require oversight.

- Vendor Lock-In: Avoided with multi-vendor or API-first strategies.

- Integration: Common to both models—hybrid models minimize friction.

- Strategic Focus: “Buy your foundation, build your advantage” — focus on customer-facing value.

7. Strategic Recommendation & Analyst Perspective

5.1 Recommendation Framework

The optimal solution for Barclays is a hybrid strategy: Use vendor systems for foundational, compliance-driven needs and build custom modules for differentiation (UX, analytics, internal dashboards).

| Criteria | Vendor | Internal Build | Hybrid (Recommended) |

|---|---|---|---|

| Speed to Market | Fast | Slow | Balanced |

| Compliance | Prepackaged | Resource-intensive | Best of both |

| Customization | Limited | Full | Prioritized |

| Risk | Lock-in | Implementation complexity | Shared |

| Scalability | SaaS-ready | Varies | Designed |

5.2 Role Fit: My Business Analyst Approach

As a Business Analyst at Barclays (JR-0000033931), I would:

- Facilitate cross-functional collaboration between compliance, IT, and product teams.

- Utilize customer insights to prioritize onboarding features.

- Apply cost-benefit and TCO frameworks for build vs. buy decisions.

- Define KPIs (e.g., onboarding duration, drop-off rate).

- Align technical decisions with long-term cloud-native architecture goals.

8. Conclusion

Modern banks like Barclays must reimagine onboarding as a strategic digital enabler. While vendor solutions accelerate deployment and compliance, internal builds offer autonomy and differentiation. A hybrid model, guided by analytical clarity and stakeholder collaboration, ensures agility with control.

Motivated to product ownership, this approach reflects a commitment to delivering data-driven, customer-centric, and compliant digital transformation within Barclays.